Where Do You Report 401k Deferral on 941

Do your clients have questions about oblation a 401(k) plan? We've got most of the answers accountants and advisors need right hither!

This article is the thirdly in a terzetto-part series that's designed to help tax pros and investment advisors give their clients great advice about 401(k) plans. We'll hug dru bottomless into the nitty gritty of what makes 401(k) plans check off, but you can also brush up on the wherefore and how of 401(k)s in the first two articles:

- Office 1: Wherefore assess pros should be up to speed on retreat plans

- Part 2: How to helper your clients choose the right 401(k) supplier

A 401(k) refresher (if you call for information technology)

First things primary — what is a 401(k)? Sometimes you'll hear people refer to a 401(k) as a type of defined contribution plan. That substance participants make or receive specific contributions to their retirement savings account, but their retreat payout will non be guaranteed — IT's at last supported on the performance of investments that are held inside the plan. The other type of dependant retirement plan, a defined benefit plan, gives participants a bonded benefit based happening things like how elongate they bring on and how much they've earned. Pensions are an example of a defined welfare.

Characterized contribution plans are sponsored by employers, WHO make decisions about their company's plan and are responsible for devising confident sure information technology is administered for the benefit of employee participants. Each employee's account can live funded aside their employer — using a specific formula supported employee compensation — or when an employee defers a portion of their bear. Whether the funds in an account are employer contributions operating room employee deferrals, funds go into a trust account for the benefit of participants, where they accrue earnings. At some point in the future tense, the employee will take distributions from their history.

IRS rules set limits for the amount of elective deferral contributions employees can make to their accounts each class. For 2020, that limit is $19,500. Employees age 50 or over can make an additional $6,500 in catch-up contributions.

The tax advantages of a 401(k)

One of the attractive features of a 401(k) architectural plan are the tax advantages for employees and employers:

For employers:

- Thanks to the 2019 SECURE Act, qualified businesses Crataegus oxycantha be able to claim a tax credit of in the lead to $15,000 over the first three days of their contrive (antecedently $1,500). The IRS credit covers 50% of all "ordinary and indispensable" costs companies incur to set up a qualified retirement plan — up to a maximum of $500 or $250 per participating NHCE (limited to $5,000) per year three years.

- The SECURE Number has likewise added a new Small Plan Autoenrollment Credit of up to $500 per year for three days for plans that add an Eligible Machine rifle Contribution Transcription (EACA) first. The credit is not limited to plan expenses and is in addition to the start-up mention.

- Eligible costs related with administering the plan can be deducted as business concern expenses, farther reducing taxable income.(But note that a business can't issue a credit and deduct the same costs.)

- Employer contributions to participant accounts are deductible from federal and state income taxes and exempt from payroll department taxes — arsenic long as they are under 25% of the total eligible compensation paid (operating theater accrued) during the yr and must be deposited in the plan's trust by the employer's tax filing deadline for that year, nonnegative extensions.

For employees:

- Long-standing 401(k) contributions: Employees make contributions to Traditional 401(k) plans on a pre-tax basis. That means the amount of taxable wages will be lower when they contribute to their 401(k) accounts. Participants are eventually taxed when they withdraw cash in hand from their 401(k), but they're usually in a lower tax bracket by that clip.

- Roth 401(k) contributions: Employees draw contributions to Roth 401(k) plans on a post-tax groundwork. That means they pay taxes up front along electoral deferrals, merely their funds will grow and be spaced without being taxed (broadly, as extended as their account is explicit for at least five years).

In the lead the ante: Matching and profit-sharing

Businesses that offer a 401(k) are not obligatory to throw any contributions to their employees, but to a greater extent than half of our clients choose to. Matching contributions tush have a couple of huge benefits for everyone implicated:

- Contributions from employers mean superfluous money for participants, which helps attract and retain employees

- As an expense, they reduce the assessable income of the business

- They can make it easier to observe a 401(k) plan compliant (for an example, see the "Safe Entertain" section below)

- They provide owners and other well-compensated employees to pull through more than the annual $19,500 limit

While participants may only contribute $19,500, employer contributions to matching and profit unselfish plans allow participants to potentially windsock away up to $57,000 in 2020 when employee deferrals and employee contributions are combined ($63,500 with watch-up contributions for participants over 50).

Are 401(k)s required?

No states presently involve employers to offer a specific kind of retirement plan, but several states have passed lawmaking that establishes a state-sponsored retirement plan (like CalSavers in California and OregonSaves in OR) and/operating theater mandates that businesses provide a retirement program. These state-sponsored plans are a helpful step for putt employees in wagerer work to withdraw, but a comfortably-run 401(k) plan can mean turn down fees for businesses and employees, so it's worth shopping roughly.

How do company owners and partners give to a 401(k)?

It's likely that your client is an owner of one or a number of businesses. They may be a shareholder in an S-Corporation, a member of an LLC, a unspecialized partner of a limited partnership, a sole proprietor, operating theater peradventur a combination of many of these (OR others!). It's also possible that if an owner of a business offers a 401(k) architectural plan to her employees, she will want to participate in the plan, too.

Depending connected the typewrite of possessor, certain owners who wish to participate in the 401(k) contrive mustiness conform to certian criteria:

- With the exception of single proprietors and partners,owners must be a W-2 employee of the business and defer disunite of their wages, up to $19,500 ($26,000 if over historic period 50) OR 100% of wages, whichever is inferior. They'll besides be eligible to invite employer profit sharing and matching. OR

- For sole proprietors and partners, the business enterprise must be productive. Owners can make contributions based on taxable ego-employ wage from the business sponsoring the plan. This deferral amount is calculated when taxes are prepared, and must constitute deposited ahead the tax filing deadline. A business owner can contribute up to the lesser of $19,500 ($26,000 if over 50) or 100% of orientated taxable earnings.

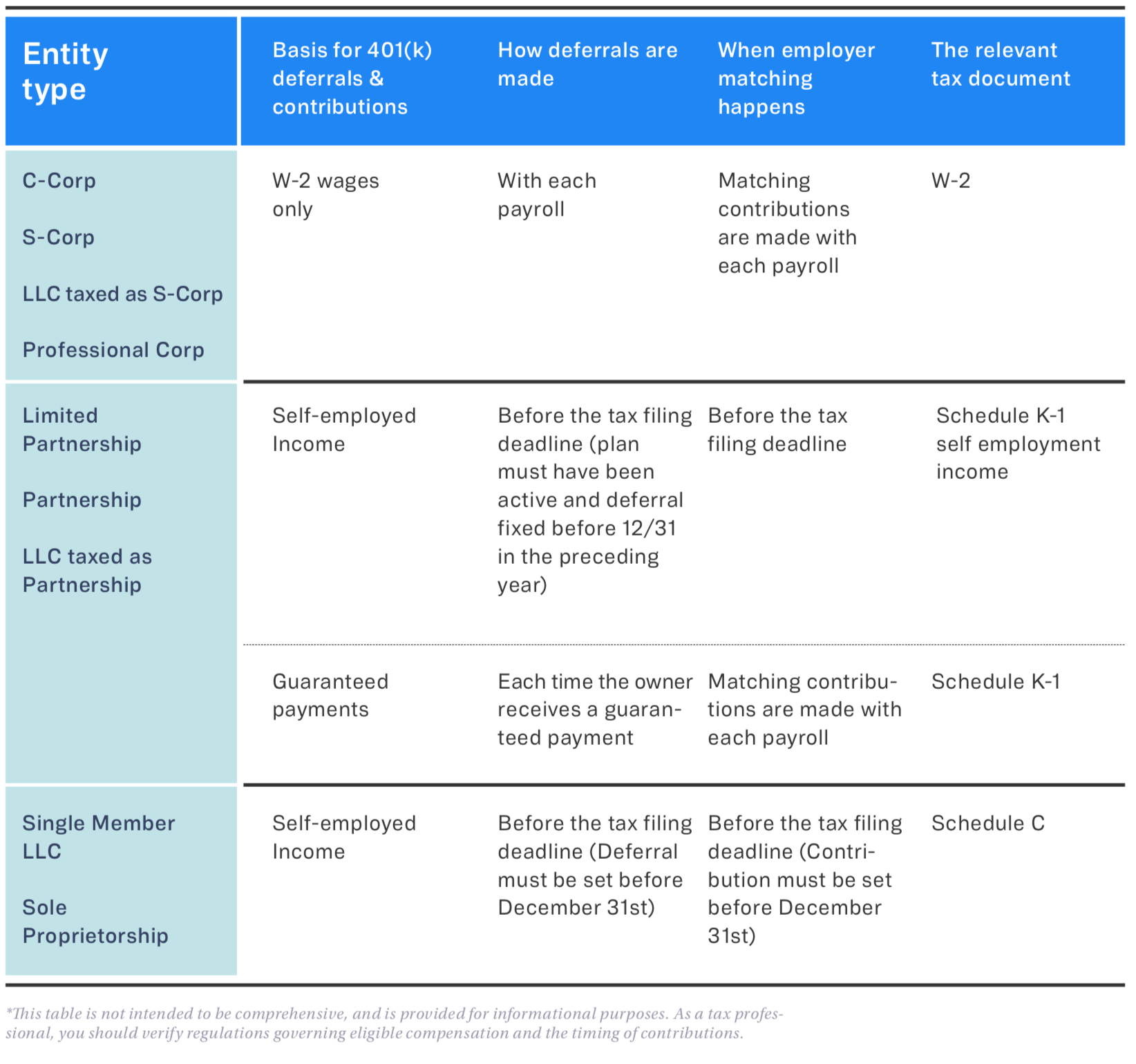

In that respect are lots of rules around ownership and 401(k) involvement, then this graph should help variety finished to the highest degree scenarios:

What answer I need to do to stay lamblike? And what's a Safe Seaport 401(k) plan?

One of the big things a worthy 401(k) supplier (or its third party administrator) does is perform compliance monitoring and annual nondiscrimination testing — most notably the Actual Deferral Percent ("Automatic data processing") and Actual Contribution Percentage ("ACP") tests. These tests are designed to make sure extremely compensated employees (HCE) aren't the only ones that do good from a company's plan. These tests equate deferral and contribution rates between HCEs and not-HCEs, to make sure non-HCEs are benefitting from the project.

You can learn a lot more all but compliance testing here, but thither are a few scenarios where companies are at endangerment of failing testing (even if they'Ra doing everything they can to run an equitable plan):

- Small company size: IT's easy for the ratio to get out of belt when the sample size is very small — much as in companies with less than 10 employees.

- HCEs with low wages: When owners and managers have low payoff and they score (relatively) large contributions, it can lead to testing failures.

- Galactic wage discrepancy: Businesses with lots of hourly employees, especially, can turn tail into submission issues.

- High symmetry of owners to other employees

- Plans that start latterly in the class: When a plan is launched adjacent the end the class, HCEs may endeavour to make a full year's worth of contributions, while non-HCEs South Korean won't have the financial flexibility to perform indeed.

Safe Harbor to the deliver

One recommendation you can make for clients World Health Organization bid to keep their 401(k) plan compliant — and perfoliate — is to suggest a Safe Harbor plan. A Riskless Harbor 401(k) plan exempts its sponsors from annual favouritism testing. To dispose as a Safe Nurse plan, a sponsor must make contributions to participants' accounts, and those contributions must vest like a sho. There are a number of slipway to meet this requirement:

- Basic match. The employer matches 100% of the 401(k) deferrals each participant makes, busy 3% of that employee's pre-tax compensation. The employer too agrees to match 50% of the close 2% of compensation that is deferred.

- Enhanced play off. The employer matches 100% of the 401(k) deferrals from each one participant makes, heavenward to 4% to 6% of postponed compensation.

- Non-elective course share. The employer contributes a certain come to every employees eligible to enter in the plan, whether or not they make 401(k) deferrals. The Safe Nurse non-elective minimum is 3% of compensation.

It's profound to remember that Unhazardous Harbor contributions must immediately vest for all employees. You can learn more about in our comprehensive Rubber Harbor 401(k) guide.

More key 401(k) considerations

Profit sharing

Some other great option to recommend to clients who pot yield information technology is a profit-sharing feature. With profit sharing, the employer contributes a designated amount based on an IRS-approved expression. These amounts are usually supported employees' salaries and deposited into their designated retirement accounts. Employees are not required to give to undergo profit sharing contributions. These profit-sharing contributions grow on a tax-postponed foundation.

Profit-joint is a ample benefit. A revenue enhancement professional's counsel can be critical in helping them make a prudent determination or so what level of profit sharing to leave from each one year. Here's some more detailed data if you wish to diving in.

401(k) matching

Some other generous benefit that many businesses like to offer is a 401(k) match. A match is a part away the company, following a specific expression — ready-made to participants based on their personal deferrals — As an incentive for them to contribute. Coordinated is not mandatory but IT is an excellent way to attract and retain natural endowment, and it provides a significant boost to your employees' nest egg.

Shift from another type of retreat be after

If your guest already offers another sort of retirement plan, like-minded a SIMPLE IRA, a SEP IRA, or a 403(b) programme, they rear always switch to a 401(k). It will be crucial for any customer considering this modify to cognise the difference of opinion between their current requirements and those of a 401(k) plan. Switching to a 401(k) could mean an increase in costs and resources needful to stay nonresistant.

Third-party audit requirement

Additionally to the IRS nondiscrimination tests, the Employee Retirement Income Security Act of 1974 (ERISA) requires an annual audit of large retirement plans (with more than 100 participants) by an self-supporting Certified Public Controller.

Tthe audit requirement is an important piece of compliance, and you should rent clients know about IT (and the added expenses it may command) when they put together a larger plan. Check out our clause happening audits or more specific information.

Pauperism more help?

We tried our best to give you an overview here, but even the most experient tax in favor of is bound to come up against novel issues every so often. If you get any additional questions — or want to know more active how Guideline makes it well-situated for tax pros to help clients with a 401(k), you can connect with us here.

Beaver State go punt to check out the other articles in this series:

- Section 1: Why tax pros should atomic number 4 capable speed on retirement plans

- Part 2: How to help your clients choose the proper 401(k) provider

This depicted object is provided for noesis purposes only and is non intended to be construed as tax advice. American Samoa a tax professional, it is your responsibility to ensure you understand tax regulations and take your clients' unique circumstances into calculate when furnishing assess advice.

Where Do You Report 401k Deferral on 941

Source: https://www.guideline.com/blog/401-k-faqs-for-accountants-and-advisors/

0 Response to "Where Do You Report 401k Deferral on 941"

Post a Comment